Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Would you like to create a personalized quote?

Donna Casados

Office Hours

After Hours by Appointment

Address

Suite B

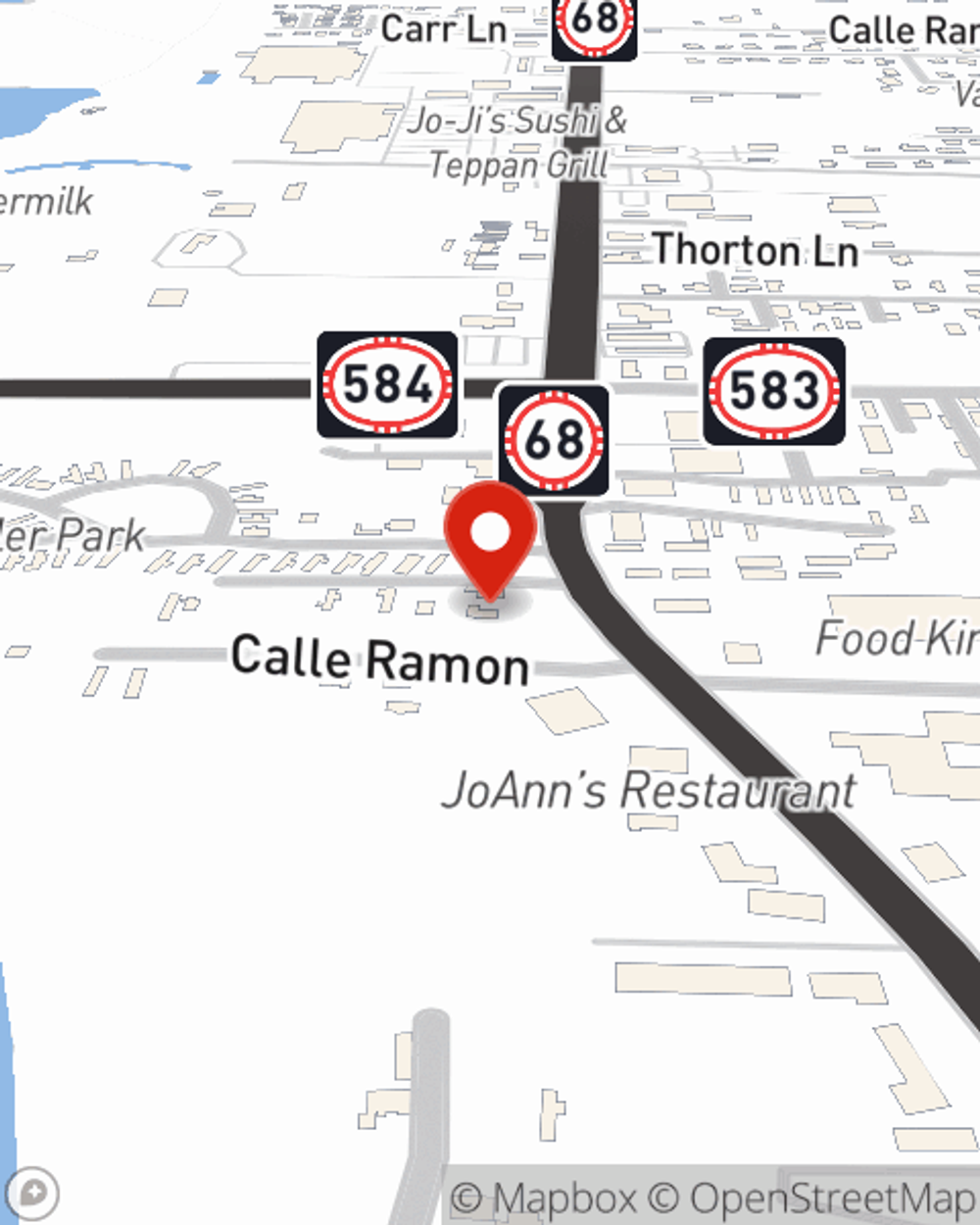

Espanola, NM 87532

Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

-

Phone

(505) 692-1284

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Office Info

Office Info

Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

-

Phone

(505) 692-1284

Languages

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Social Media

Viewing team member 1 of 2

Skylor Casados

Account Manager

License #20333941

I live in Espanola and am a graduate of Los Alamos High School. I love helping our customers with tricky insurance issues, and pride myself on my dedication to finding the right policy options for every customer.

As a car enthusiast I am always excited to talk cars, and Car Insurance with our customers! When I am not working, I ride bikes, drive cars, and hunt & fish. Give me a call!

Viewing team member 2 of 2

Lisa Morehead

Account Manager

License #3400815

Meet Lisa Morehead: a Texas-born, Ohio-seasoned insurance pro with a heart as big as the Lone Star State! After kickstarting her 20-year career with State Farm in Ohio, Lisa took a scenic detour to the stunning landscapes of New Mexico. Now back with State Farm, she’s passionate about helping people navigate life’s twists and turns—managing risks, bouncing back from surprises, and chasing their dreams. When she’s not busy being a risk-management guru, Lisa loves adventuring with her husband and their pup Diego, solving puzzles, and adding to her quirky collections of frogs and nutcrackers. A true shoe and handbag enthusiast, she also enjoys hiking, walking, and savoring some quiet downtime. Life’s an adventure, and Lisa’s here to help you enjoy every step of the journey!

Yes, I am Bilingual!